Hey there, freelancer! Tax season doesn’t have to be scary, especially when you know how to use deductions to keep more of your hard-earned money. Here’s a simple official guide to the most common expenses freelancers can claim to lower their tax bill. We’ll also clarify if everyday items like meals, cable TV subscriptions, or books can be claimed. Let’s dive in!

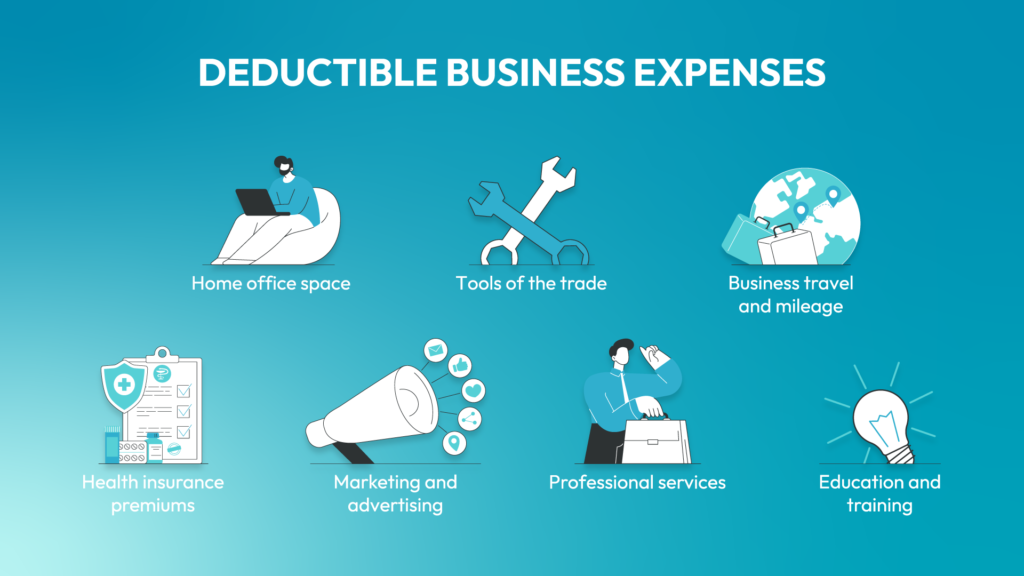

1. Home Office Space

Got a dedicated spot at home where you work your magic? Whether it’s a full room or just a cozy corner, you can deduct a portion of your rent or mortgage, utilities, and even internet costs. Use the simplified method to claim $5 per square foot, up to 300 square feet. It’s easy and avoids complicated calculations. Just make sure it’s used exclusively for work—no Netflix binging allowed!

IRS Rule: To qualify for this deduction, your home office must be your principal place of business, and the area must be used regularly and exclusively for work.

2. Tools of the Trade

Need a laptop, software, fancy camera, or even a printer for your work? These are deductible! Even smaller items like notebooks, pens, or that ergonomic chair count too. Basically, if you’re using it for work, it’s probably deductible. Keep receipts for everything—even for that mouse pad with the wrist support.

IRS Rule: Equipment and tools used for business can often be fully deductible in the year of purchase under Section 179, or depreciated over time if the cost is significant.

3. Business Travel and Mileage

Driving to a client meeting or picking up supplies? Track your mileage. You can deduct the cost of work-related travel, whether it’s by car, plane, train, or even bike. Hotels and meals during business trips? Those count too! Use an app to track your miles—it’ll save you a ton of time and hassle.

IRS Rule: The standard mileage rate for 2023 is 65.5 cents per mile. Keep a detailed log of your business-related travel, including dates, mileage, and purpose.

4. Health Insurance Premiums

Freelancers pay for their own health insurance, and guess what? You can deduct those premiums, up to 100% of the cost if you’re self-employed and not covered by any other plan. This deduction can be a huge help when you’re juggling all the other costs of being self-employed. Just be aware that this deduction applies to health, dental, and long-term care premiums for yourself, your spouse, and dependents.

IRS Rule: This deduction is claimed on Form 1040, Schedule 1, and cannot exceed your net self-employment income.

5. Marketing and Advertising

Spent money on promoting your services? Ads, social media boosts, website hosting, and even business cards can all be deducted. If it helps you land clients, it’s fair game.

IRS Rule: Any expense directly tied to promoting or advertising your business is deductible under ordinary and necessary expenses.

6. Professional Services

Got an accountant or lawyer helping you out? Their fees are deductible. Paying for a coworking space? Deduct that too. These are essential costs of running your business. Keep contracts or invoices as proof of these expenses.

IRS Rule: Professional fees for services that are ordinary and necessary for your business operations are deductible.

7. Education and Training

Sharpening your skills with an online course, workshop, or certification? Deduct those fees! Books and training materials count too. Just make sure the education is directly related to your freelancing work. For example, a pottery class for a graphic designer? Probably not. A Photoshop course? Absolutely!

IRS Rule: Education expenses must maintain or improve skills required in your business or be required by law to maintain your professional status. They cannot qualify you for a new trade or business.

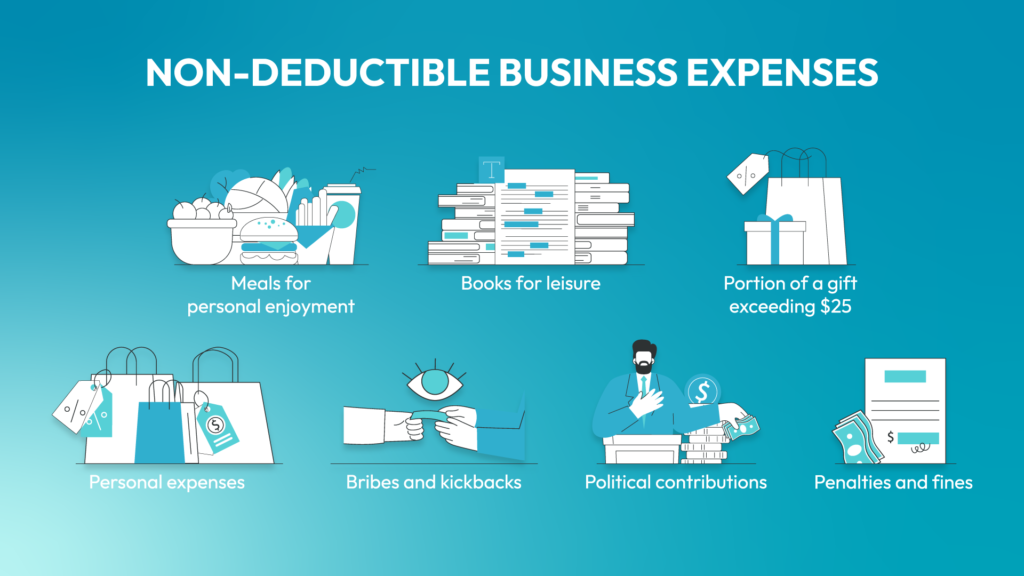

8. What You Can’t Deduct

Not everything counts as a business expense. Here are some common items that usually can’t be deducted:

- Meals for personal enjoyment: Unless it’s a meal during a business trip or with a client, personal dining expenses don’t qualify.

- Cable TV subscriptions: Only subscriptions directly related to your work, like an industry-specific channel or tool, are deductible. Watching your favorite shows doesn’t count.

- Books for leisure: Books unrelated to your work or skill development, such as novels or non-work-related guides, are not deductible.

- Clothing: General wardrobe items aren’t deductible, even if you wear them to work. However, specialized uniforms or safety gear can qualify.

- Gifts: Gifts for clients or business partners can be deducted, but there’s a limit. You can only deduct up to $25 per person per year. Keep track of who the gift is for and ensure it’s business-related.

- Personal expenses: This includes gym memberships, home decor, or any expense not directly tied to your freelancing business.

- Bribes and kickbacks, political contributions, penalties, and fines: The IRS strictly prohibits these from being deducted.

Always ask yourself: “Is this expense directly related to my work?” If the answer is no, it’s likely not deductible.

TL;DR Quick Reference Table

| Deductible | Non-deductible |

| Home office space | Personal home décor |

| Business equipment & tools (laptop, software) | Personal electronics (gaming consoles) |

| Work-related travel & mileage | Personal leisure travel |

| Health insurance premiums | Personal gym memberships |

| Marketing & advertising (ads, business cards) | Cable TV subscription for entertainment |

| Professional fees (accountants, lawyers) | Bribes, kickbacks, political contributions |

| Education & training related to your field | Hobby classes unrelated to your work (e.g. pottery) |

| Business meals (with clients) | Meals for personal enjoyment |

| Books related to skill development | Books for leisure |

| Specialized uniforms & safety gear | General clothing |

| Gifts up to $25 per recipient | Non-deductible amount: Any portion of a business gift exceeding $25 per recipient |

Final Thoughts

Taxes don’t have to be a headache. By keeping track of these common deductions, you’ll not only save money but also feel more in control of your finances. Start tracking your expenses and keeping those receipts handy—every bit counts! For more tips on managing self-employment taxes, check out our blog, Self-Employed? Here’s How to Handle Taxes Like a Pro.

(Remember, these are just some common examples—there’s plenty more out there. If you’re not sure about a specific expense or think we’ve missed something, just check out the IRS website or talk to a tax pro for the full scoop.)

Happy freelancing!