Freelancing comes with its own set of challenges, especially when it comes to managing money. Cash inflows and outflows can feel unpredictable, making planning difficult. Cash flow projections give you control over your finances. They help you prepare for the unexpected, make smart decisions, and ensure your business stays on solid ground.

What are Cash Flow and Cash Flow Projection?

Cash Flow refers to the money moving in and out of your freelance business. Cash inflows are the payments you get from clients or other income sources. Cash outflows are the money you spend on things like subscriptions, marketing, or travel.

A Cash Flow Projection is your money management plan. It predicts your future inflows and outflows, helping you avoid surprises and confidently handle both busy and slow periods.

Why Cash Flow Projections Matter

Freelancers often deal with irregular income and sudden expenses, but a cash flow projection keeps things under control. Here’s why they’re important:

- Track where your money is coming from and going.

- Plan for regular outflows like taxes or subscriptions.

- Avoid cash shortages by preparing for slower months.

- Stay in control of your finances and focus on your work without worry.

Understanding Your Finances

To create a cash flow projection, you first need to understand the basics of your finances:

Cash Inflows

- This is the money you earn. For freelancers, it might include:

- Project Payments: One-time payments for specific jobs

- Retainer Fees: Ongoing payments for long-term work

- Side Income: Money from things like affiliate marketing or selling digital content

Cash Outflows

This is what you spend to keep your business running. Common examples are:

- Business Costs: Supplies, travel, or tools needed for your work

- Subscriptions: Tools like Canva, Adobe Suite, or website costs like hosting and domain names

- Professional Help: Paying for accountants or consultants

- Advertising: Spending on ads, email marketing, or social media promotions

- Taxes and Fees: Self-employment taxes or other required payments

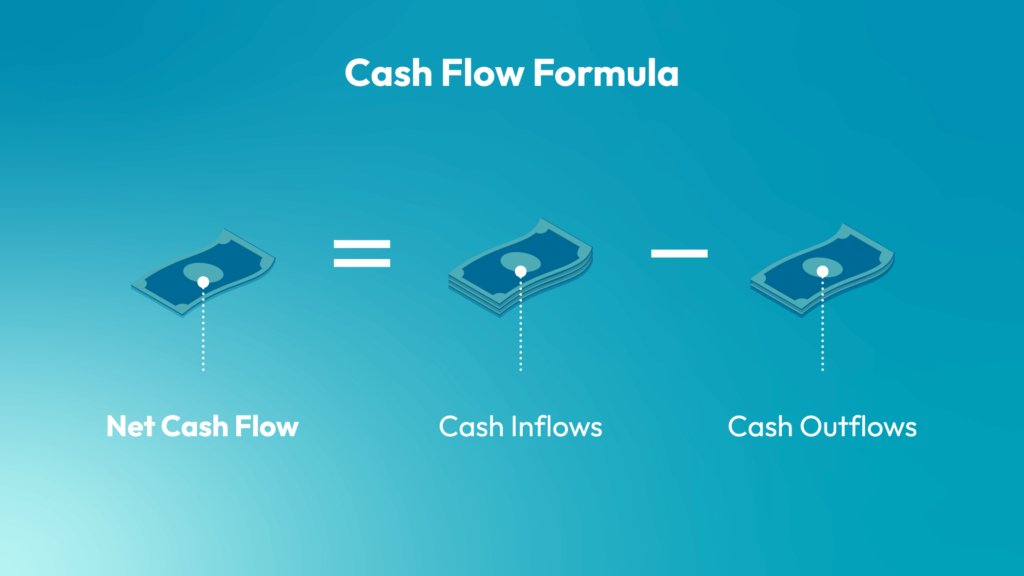

Net Cash Flow

Net cash flow is the difference between your inflows and outflows:

Net Cash Flow = Cash Inflows – Cash Outflows

Positive Net Cash Flow: You’re earning more than you’re spending—great!

Negative Net Cash Flow: You’re spending more than you’re earning—time to adjust.

Balances

Your balance is the amount of cash you have at the start or end of a period:

Opening Balance: Cash you start with.

Closing Balance: Cash left after accounting for all inflows and outflows.

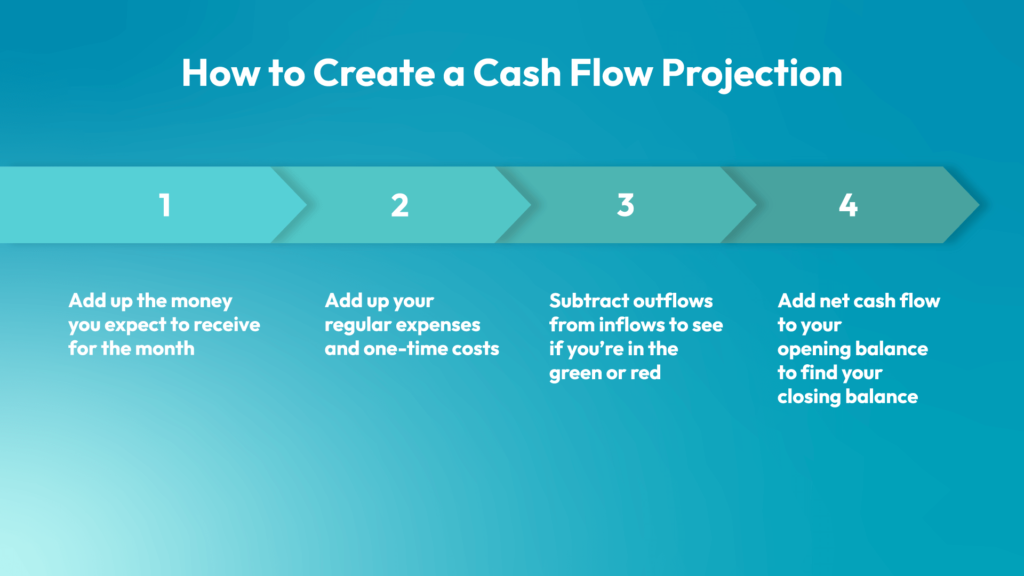

How to Create a Cash Flow Projection

Making a projection is simple! Here’s how to do it:

- Add up the money you expect to receive for the month.

- Add up your regular expenses and one-time costs.

- Subtract outflows from inflows to see if you’re in the green or red.

- Add net cash flow to your opening balance to find your closing balance.

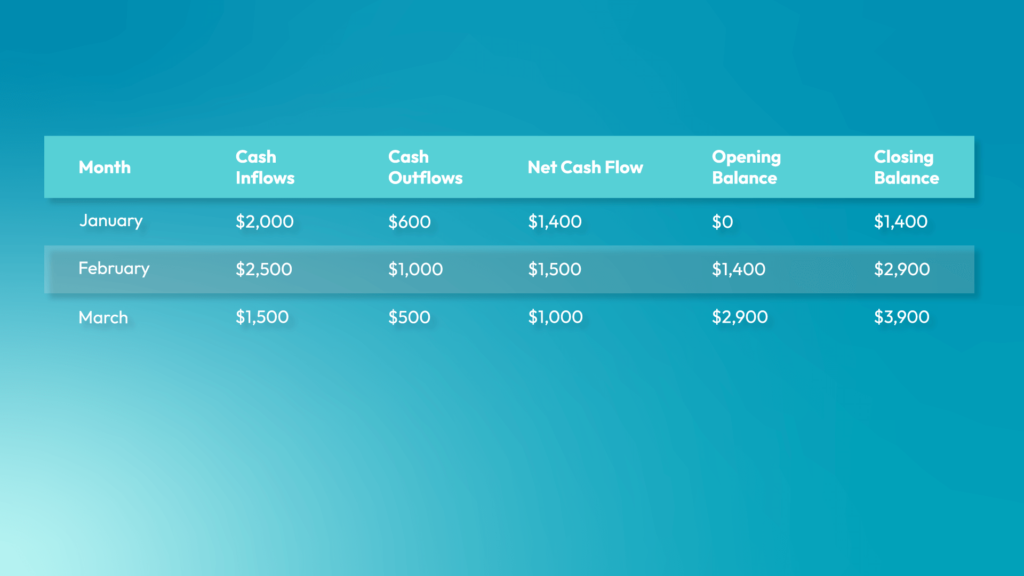

Example Projection Table:

Tips for Better Projections

- Use Past Data

Check your past inflows and outflows to make accurate estimates. - Plan for Slow Times

Adjust projections for quiet months in your schedule. - Be Realistic

Avoid overestimating inflows or underestimating outflows. - Include Big Expenses

Don’t forget taxes or occasional equipment upgrades. - Update Monthly

Revisit your projection to account for changes in your work or spending. - Watch for Payment Delays

Only include money you’re sure to receive that month.

Why Cash Flow Projections Are Worth It

Cash flow projections help you stay on top of your money. They show you how to avoid running out of cash during slow months, handle surprise expenses like taxes or fixing your laptop, and plan for the future. Whether you’re saving for emergencies, buying better tools, or building up your business, cash flow projections make managing your finances simple and less overwhelming.

Start Your Projection Today!

It only takes a few minutes to create your first projection. It’s simple, effective, and one of the best steps you can take to manage your finances with confidence. Get started today with your free Fynlo account.